Mortgage loan procedure in Armenia, 2019

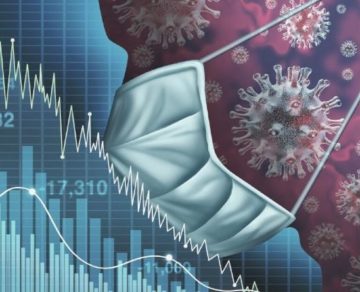

In Armenia, the market of real estate is active, and the market of mortgage loans – much more. A,s statistics show in comparison with February 2018 , in February 2019 the volume of mortgage loans increased by 100%. And on the general loaning volume the percentage of mortgage loans increased by 30%.

According to professionals, in Armenian banks and credit organizations this unprecedented increase in mortgage loaning is due to the improvements of its conditions, including year-by-year simplification of the formation process.

Therefore, how and under which conditions the mortgage loan is formatted, what documents are required for this process.

The conditions of mortgage loan formation for residential houses and apartments

If you have decided to apply for a mortgage loan, firstly, you should decide the bank; get information about the offered percentages and other conditions. Alternatively, just ask to a professional realtor who knows about the sphere, can suggest which bank to choose and, overall, how to organize the whole process of mortgage loan.

Note, that in recent years the formation of mortgage loans is significantly simplified and is more accessible for a public. Let us discuss some details about the ways and formation process.

There are several mortgage loan opportunities:

First option: If you are buying an apartment in a newly built building and directly from the owner, which price does not exceed 55 million Armenian drams, then according to the “About the return of Income tax” law, the percentages of mortgage loan are returned from the income tax. The documents are presented to the Tax inspectorate, and after that once in three months references are presented from the bank and employer to the tax office. In this way, it is possible to get a loan from any bank with small differences in terms and percentages. In addition to that, every citizen can take advantage of this form of credit only once.

Second option: If you are buying an appartment which price does not exceed 25 million Armenian drams, then you can benefit from “Appartment for young people” program. It is financed by National mortgage loan company. For details, proinfo.am will publish seperate analysis.

National mortgage loan company also offers accessible credits. Overall, in the market a drop of percentages is noticable, as there is a huge competetion between the banks, and a rising demand in a market.

An important notice: depending from the type of mortgage loan there are several income calculation indexes for the borrower, which are applied during the formation of the loan – 1. PTI, when the loan repayment volume does not exceed 35% of the income. 2. OTI- the share of financial liabilities should not exceed 45% of the income, 3. LTV loan-mortgage ratio, in which case the loan should not exceed 70% of the property value. These are base ratios, which are applied in the process of creditworthiness of the customer. There are also banks, which have other mechanisms and tools creditworthiness assessment.

The conditions of providing young families with mortgage loans

Recently, the government of RA approved the suggestion of making changes in the “About the approval of changes in «Accessible houses for Young families» state targeted project” on January 29, 2010. According to the changes, it is possible to purchase an apartment by 7.5% instead of 9.5%. Also note that 2% out of 7.5% is subsidized by the government, which means that through this project the borrower should pay an average of 5.5% service. The overall sum of the couple’s age is raised from 65 to 70, and the restriction of being at most 35 years old for each of the spouses is lifted. The cost of the apartment is also raised; currently the young family can purchase an apartment worth 30 million Armenian drams instead of previous 25 million. According to the specialists, I is possible that these improvements will lead to a boom in the mortgage loan market.

What documents are necessary for processing a mortgage loan

The process of taking a mortgage loan has number of details connected with the formation of documents, pledge registration and the main action of signing the contract. The names of the sides, places of residency, the object of the mortgage loan and other details are mentioned in the contract. It is certified by notary procedure. As regard documents, several required and additional documents are compulsory for processing the mortgage loan. The required ones are:

- the passports of the borrower and the co-borrower (if applicable)

- certificate of ownership

- passports of the sellers

- the basis for acquiring housing, an income statement

- on credit history

- a unified certificate of reference if the loan is approved, so the pledge and acquisition contract can be signed

There is no fixed list for additional documents as it depends on the specific bank, the borrower or the sold property connected with special occasions and other circumstances.

By the way, the new beneficial approach of the RA government does not exclude the possibility of simplifying the mortgage loaning processes and making it more accessible involving a bigger part of population.